Mastercard’s Philanthropic Hub Hosts Summit On Financial Inclusion

Reward bank cards permit customers to earn incentives for making purchases with their credit card. Points accumulate for every greenback charged on the card, and cardholders can redeem these factors for various rewards. Reward cards normally require better-than-average credit score for approval. There are seven main varieties (not including airline miles / frequent flier playing cards, which we’ll talk about a bit later).

Some cards are co-branded with a particular airline, while some are generic and could be redeemed for tickets with a variety of airways. Points could be redeemed for airline journey, much like frequent flier miles. This is a genre of bank cards specific to hotels and journey. These credit cards allow you to earn factors for all purchases, in addition to bonus factors for dollars spent on stays at the respective resort chain. You can redeem your factors at no cost nights and upgrades at the lodge chain your card is co-branded with.

- Your routing number identifies the situation where your account was opened.

- While certain common reward bank cards enable points to be redeemed for airplane tickets among other things, there’s a subset of reward playing cards specifically for air travel.

- How long the COVID-19 pandemic lasts and the way deep the resulting recession could be are anyone’s guess at this point.

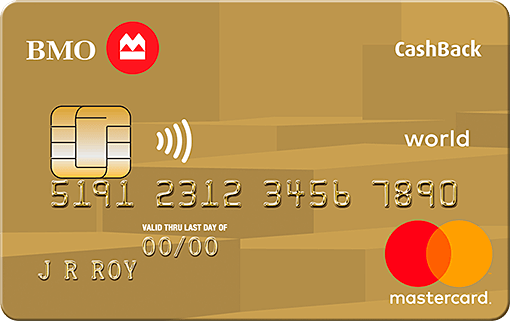

- The credit card account quantity will be made up of a certain quantity of digits which shall be displayed on the entrance of the cardboard with a security number on the rear face of the card.

- World of Money’s free academic app helps families worldwide educate their kids about the power of digital payments and financial well being.

The company partners with quite a lot of institutions to supply several kinds of cards. Comprehensively, its card choices span throughout credit score, debit, and prepaid playing cards. The majority of MasterCard’s enterprise is through partnerships with monetary institutions and retailers to offer both open-loop and closed-loop options. MasterCard itself is a monetary services business that primarily generates income from gross dollar volume (GDV) charges.

This signifies that if, for example, you make a fee online and your desired product by no means arrives, you need to be able to declare the money again out of your financial institution or credit provider. Credit playing cards are nice for making large purchases for two causes. Firstly, they allow you to spend cash you don’t have, meaning that you simply aren’t constrained by timing of pay cheques and also you don’t have to avoid wasting up for as long a time to be able to purchase expensive things. Put simply, debit cards are hooked up to a bank account and permit you to spend existing funds, whereas credit cards permit you to spend credit that you just then pay again at a later date. CreditCards.com is an unbiased, promoting-supported comparison service.

Balance switch credit cards allow customers to transfer a high interest bank card balance onto a bank card with a low rate of interest. Typical out there right now are steadiness switch bank cards with an introductory annual percentage fee (APR) of zero percent, with that introductory or “teaser” price lasting several months as much as a yr. The terms of balance switch bank cards varies between provides, so be sure to thoroughly read the terms and circumstances for every card. In order to accept MasterCard digital payments, a merchant should have their own (acquiring) bank that is able to receiving digital payments on the MasterCard network.