Best Deals Online to Shop At Lowest Prices

You can redeem cash back as an automated deposit to your financial savings account or as a credit in your checking, savings or cash market account with Discover. Rewards do not expire as long as your account is saved in good standing. Discover’s cashback debit card gives you as much as $30 back from your purchases per 30 days, for a maximum reward of $360 a year.

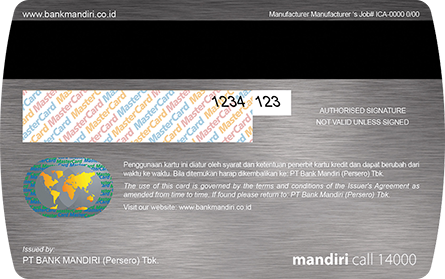

Since neither company extends credit or issues playing cards via a banking division, each have a broad portfolio of co-branded offerings. Visa and MasterCard do not issue cards on to the public, as do Discover and American Express, however rather via member monetary institutions. Visa and MasterCard are the two largest fee processing networks on the earth. Get unlimited deliveries with a $0 delivery payment and decreased service charges on orders over $12 for no less than one 12 months on qualifying food purchases with DashPass, DoorDash’s subscription service.

Debit cards, linked to your bank account, may also have your 8-digit account number printed on the front of the cardboard, in addition to a 6-digit type-code, figuring out your bank branch. The greatest cost processors are Visa and Mastercard, and there is a good likelihood you will see the emblem of one or the opposite printed on your card.

- Use this calculator to find how one can maximize your PC Optimum factors with a President’s Choice Financial Mastercard.

- They typically don’t cost the annual fees that some bank cards do.

- Like credit cards, pay as you go debit playing cards hold your main checking account from being uncovered to the world.

MasterCard Explained

Like debit cards, prepaid playing cards stop you from going into debt because you’ll be able to only spend funds that you just’ve loaded on the card. You received’t pay any curiosity costs when you pay off your credit card balances in full each month. However, one of many cons of debit cards is that they make spending slightly less handy for the buyer. Unlike with a credit card, you’ll be able to’t simply swipe a debit card; you additionally need to enter a personal identification number (PIN) to forestall others from stealing your card and misusing it. However, if you run out cash, the cardboard might be declined unless you choose into overdraft protection, by which case the financial institution can pay for the transaction.

In order to be eligible for the coverage most credit card issuers require that a cardholder pay his monthly cell phone bill together with his bank card. All Discover playing cards include this profit, which features very like the money-back option for debit cards. When making a purchase order at collaborating retailers, money-back can be obtained instantly from the cashier. With playing cards that supply return safety, eligible purchases can be returned for a refund even if the retailer refuses to take them back. This benefit usually has a time restrict of around 60 days from the date of purchase, and a greenback restrict per merchandise and per yr.

Some credit card issuers supply cell phone substitute insurance to their prospects. When the perk is obtainable it typically covers the alternative value of a new cell phone within the occasion of harm or theft.

When you employ one, cash instantly will get taken out of the linked account. Enjoy the finer side of life with a excessive spending line, a revolving line of credit score, emergency card replacement, and cash disbursement providers.